Let’s Help 1,000 Working Families Realize Their Dream of Homeownership

$40M Workforce Housing Downpayment Assistance Fund Would Provide Zero-Interest, Zero Payment Loans to Qualified First-time Homebuyers

Montgomery County faces a workforce housing crisis. The median home price exceeds $600,000, yet teachers, nurses, police officers, and firefighters—the essential workers who make our community thrive—increasingly cannot afford to live here. These working families can afford monthly mortgage payments but cannot save the tens of thousands of dollars required for a down payment and closing costs in today’s market.

Equally affected are longtime renters who have called Montgomery County home for years. They pay $2,000-$3,000 or more in monthly rent—proof they can afford a similar mortgage payment—but the down payment barrier keeps them trapped in a cycle where they build wealth for landlords instead of themselves. After 3, 5, or even 10 years of renting, they still cannot accumulate enough savings while paying high rents to make the leap to ownership.

Council Member Jim McNulty Proposes $40M Workforce Housing Fund

The result: We’re losing the workforce that powers our schools, hospitals, police departments, and fire stations to more affordable jurisdictions. Families who have invested years in our community as renters are being forced out or remain permanently locked out of homeownership. This threatens our economic vitality, our public services, and the character of our community.

As a Gaithersburg City Councilmember, I voted to expand our municipal downpayment assistance program (formerly known as GHALP). It now offers up to $40,000 per household in the form of a zero-payment, zero interest loan. The loan isn’t paid back until the home is sold or the primary mortgage is paid off. Our program is working, with over $5 million in loans made to first-time homebuyers since its inception—helping working families become homeowners and begin building generational wealth. But it only serves current city residents buying within Gaithersburg city limits.

I propose scaling this proven model county-wide through a $40 million Montgomery County Workforce Housing Downpayment Assistance Fund that will help 1,000 working families achieve homeownership in its first phase, then continue helping 140+ families annually in perpetuity.

This program prioritizes those who serve our community—teachers, nurses, police, firefighters—and longtime renters who have demonstrated commitment to Montgomery County but have been unable to save enough for a down payment despite steady employment and responsible financial management.

My proposal would provide downpayment assistance to these vital members of our community who could qualify for an FHA loan but lack the funds needed for closing costs. For example, the closing costs on an FHA loan at 3.5% down on a $500,000 mortgage can range from $25,000-$40,000. At the same time, we would free up 1,000 rental units for other working families.

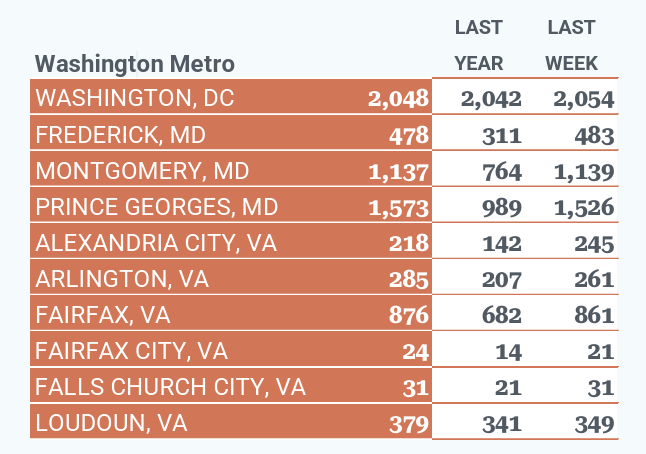

*Active Listings for Montgomery County, MD, from BrightMLS for the week ending January 18, 2026. © 2026 BrightMLS.

Supply and Demand

Over the summer, an analysis by the Pew Charitable Trust showed how increasing housing availability at all income levels improved affordability through the moving chain. As a Realtor®, I see every day the challenge both renters and homebuyers have in finding a place to call home. But the current economic conditions have swung the for-sale housing market back in the direction of buyers towards a more neutral market. In fact, Montgomery County currently has 48.9% more active for-sale listings than it did one year ago*, with 542 properties with an asking price of $500,000 or less listed as either active or coming soon as of January 26. With new multifamily housing projects in the County stalled due in large part to rent control, getting working families into for-sale properties is great opportunity to increase availability within existing rental inventory and reduce upward pressure on rent prices as well. The increase in housing sales will also stimulate additional recordation tax receipts.

Who It Helps

Priority Populations:

Teachers (K-12 public and licensed private schools)

Nurses and healthcare workers

Police officers and law enforcement

Firefighters, EMTs, and paramedics

Longtime Montgomery County renters (3+ years residency)

Other essential county workforce

Eligibility:

Income up to 120% Area Median Household Income (AMI) for priority populations (Approximately $155,000)

Income up to 100% AMI for other applicants

First-time homebuyers (no home ownership in past 3 years)

Must qualify for FHA, VA, USDA, or conventional mortgage

Purchase within Montgomery County

Multiple Funding Sources

Initial Investment

Housing Revenue Bonds: $20M (self-liquidating, primary source)

General Fund (Assign Existing Recordation Revenue): $12M over 3 years (3.1% → 2.5% → 1.9% of $160.8M annual recordation revenue)

Private Sector Partnerships: $6M (healthcare, employers, real estate, banking/insurance)

Federal Funds: $2M (HOME/CDBG)

Total: $40M

After Year 9

Fund maintains itself through repayments

Supports 140 loans each year without general fund support

Creates permanent pathway to homeownership for working families.

This is How We Meet the Moment

Multiple challenges have coalesced to create an affordability problem in Montgomery County. DOGE cuts, Trump’s tariffs, and policy decisions continue to drive up the cost of living here for all of us. We need real, actionable programs that invest in our community. This program isn’t a giveaway—it’s a head start. It’s betting on our working families, while building on a framework that’s already working. This is how we meet the moment, and together we can create a better future for Montgomery County.